THE INSIDE STORY: Venture Minerals (ASX: VMS) is hoping the lithium-focused electronic car boffins can find room to introduce tin to their conversation.

With lithium dominating the battery world mind-set, some of what most pundits consider as the more traditional commodities, have been forced to share the back seat of the anticipated electric car revolution.

Nickel is one such example. The metal was fast becoming one of John Paul Young’s, Yesterday’s Heroes until it received a boost from an off-the cuff remark by Tesla boss Elon Musk in 2017.

Tin is another of these old-school commodities that is well-placed to enjoy a long-term future as an innovative, competitive and sustainable material.

There are plenty of uses in modern-day technology where tin is already a vital element.

These include solar panels where tin is making its mark on the next generation of cheaper solar cell materials, making ready to replace more expensive and nowhere near as abundant elements.

Tin has also been shown to make lithium-ion batteries last more than three times longer, positioning it as an obvious choice to meet the anticipated demand for better batteries in mobile phones, cameras, iPads and other mobile devices.

Of course, a new market for tin, as it is for all metals involved, is the use of lithium-ion batteries in hybrid and all-electric cars.

Tin gained a lot of domestic credence earlier this year when global powerhouse Rio Tinto presented at a battery metals conference in Perth.

Part of the Rio presentation was a slide showing the metals most impacted by modern technologies, ranked by the Massachusetts Institute of Technology (MIT).

Although Rio was using the information to push its Jadar lithium project in Serbia, using the MIT ranking to show lithium as the second most impacted metal, with the tin sitting above the market’s recent hot commodity, separated by a good amount of daylight.

MIT credited the result to tin’s applications across a range of modern technologies, ranging through autonomous and electric vehicles, advanced robotics, renewable energy, advanced computation and information technology.

Venture Minerals recognised this as the ideal time to raise the flag on the company’s Mount Lindsay project in Tasmania and immediately set a detailed reassessment of the project’s high-grade tin and tungsten Resource base in motion.

Venture Minerals has long-touted Mt Lindsay as being one of the world’s largest undeveloped tin projects, one that is ideally placed to take advantage of the recent rise in both interest and the price of tin.

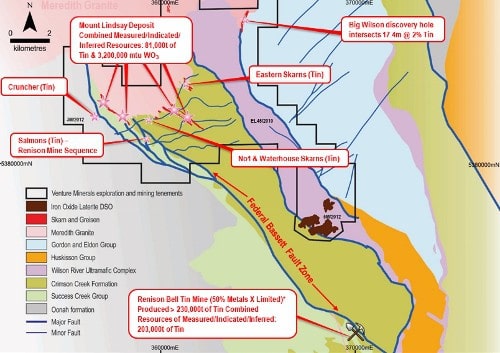

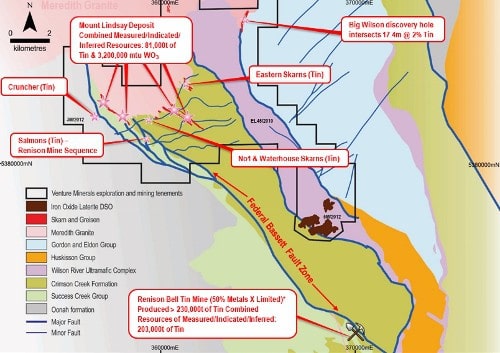

The 148 square kilometre Mt Lindsay project is in north-western Tasmania within the contact metamorphic aureole of the highly perspective Meredith Granite.

The project sits between the world class Renison Bell tin mine, which has produced more than 231,000 tonnes of tin metal since 1968, and the Savage River magnetite mine that has operated for over 50 years and currently producing approximately 2.5 million tonnes per annum of iron pellets.

Venture owns 100 per cent of the tenure that hosts both the Mt Lindsay tin-tungsten deposit and all surrounding prospects.

Since commencing exploration on the project in 2007, Venture has completed approximately 83,000m of diamond core drilling at Mt Lindsay, from which it has defined JORC compliant Measured, Indicated and Inferred Resources of 4.7 million tonnes at 0.4 per cent tin and 0.3 per cent WO3 with over 60 per cent in the Measured and Indicated categories.

A Feasibility Study completed on the project with comprehensive metallurgical test-work and post feasibility determined a very high-grade 75 per cent tin concentrate result Venture considers to likely attract price premiums.

In 2012, Venture Minerals claimed a major new high-grade tin discovery only six kilometres from the Mt Lindsay project when drilling encountered a 47-metre intersection of tin mineralisation at the Big Wilson prospect that included: 17.4 metres at 2 per cent tin, including 4m at 5.6 per cent tin.

Venture Minerals interpreted the results as being a combination of high-grade skarn style mineralisation and, typically large tonnage, greisen style mineralisation.

The high-grade nature of the earlier Big Wilson drilling opens depth opportunities, as these grades would be amenable to underground mining.

The company has made its intentions clear that it will be considering strategies to optimise the higher-grade portions at Mount Lindsay.

Venture will now look to focus on assessing the underground mining potential of this high-grade resource.

“Knowing that the Mount Lindsay project has a large tin Resource that could be harnessed to meet applications in Electrical Vehicles and renewable energy has refocussed the company to revisit its approach in developing this asset,” Venture Minerals managing director Andrew Radonjic told The Resources Roadhouse.

“Mt Lindsay is a very advanced project in Tasmania that has plenty of Resource tonnes but has a higher-grade core that we could approach from an underground perspective.

“We have a fair degree of confidence in developing an underground operation there.

“Instead of originally looking to maximise the Resource through mostly open pit mining 14 million tonnes of ore we would more likely be looking at mining four million tonnes from purely underground which we believe is the best way of bringing forward tin and tungsten production from Mount Lindsay.

“We also have a number of high-grade targets that we can follow up.”

While the potential of Mt Lindsay continues to mount, Venture Minerals is focusing most of its current attention on the company’s Thor VMS prospect in Western Australia.

Venture has identified nine priority VMS (Volcanogenic Massive Sulphide) drill targets from preliminary results it received from an EM (Electromagnetic) survey carried out at the prospect.

Venture’s continued exploration efforts on Thor follow its recent discovery of massive and semi-massive sulphides in reconnaissance drilling targeting a large historic EM anomaly.

The company anticipates final processing of the new detailed survey, which utilised the latest EM technology, will shortly be complete, from which it will prioritise the targets in preparation for immediate drilling.

There has been a great deal of activity at Thor in recent times, including:

Completion of a high-resolution Xcite™ Airborne EM survey by New Resolution Geophysics (NRG) over the Thor prospect delivering the nine priority VMS style drill targets;

Confirmation of large VMS style target sequence extending over 20 kilometres of strike;

A maiden drill program that intersected a 17m zone of disseminated, semi-massive and massive sulphides using portable XRF confirming the presence of zinc and copper; and

Recent assays confirming the presence of zinc and copper with core samples containing up to 0.3 per cent zinc and 0.2 per cent copper.

Venture has now commenced work on the recently granted northern tenement at Thor (E70/5067), which holds 14 strike kilometres of the Thor VMS target zone with a surface geochemical sampling program.

Thor has the same EM and geochemical signature as Teck’s adjacent VMS Kingsley discovery, which is one of several VMS occurrences in the Archean Yilgarn Craton of Western Australia with the Golden Grove Camp (Mine), 450kms north-east of Perth, being the prime example with over nine VMS deposits spread over 13kms of strike.

“The early success we enjoyed from the EM survey was highly-encouraging,” Radonjic said.

“We are now looking forward to testing some of the nine priority drill targets as soon as we can.”

Venture Minerals Limited (ASX: VMS)

…The Short Story

HEAD OFFICE

Suite 3, Level 3

24 Outram Street

West Perth, WA, 6005

Ph: +61 8 6279 9428

Email: info@ventureminerals.com.au

Web: www.ventureminerals.com.au

DIRECTORS

Mel Ashton, Andrew Radonjic, Hamish Halliday, John Jetter