THE CONFERENCE CALLER: Diversified junior Venture Minerals (ASX: VMS) looks set to become Australia’s next iron ore miner – possibly by late October – at its Riley hematite operation in north west Tasmania. By Mark Fraser

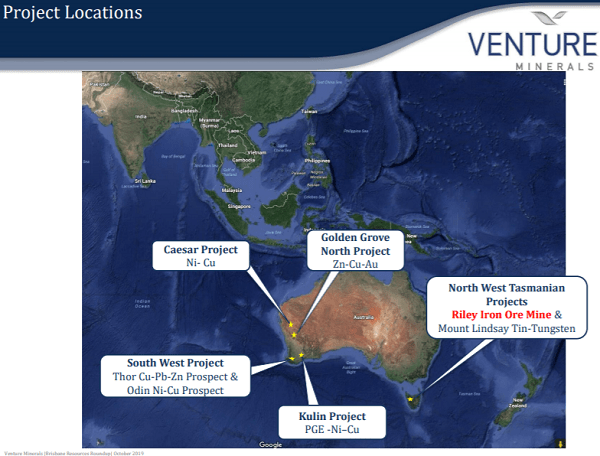

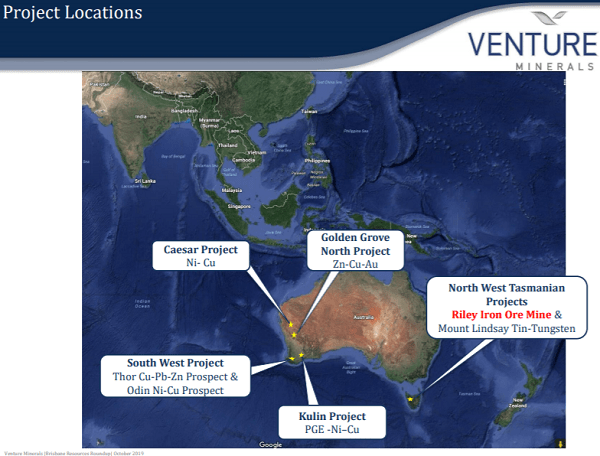

The company currently boasts a diverse exploration portfolio covering a slew of mineral commodities and recently consolidated its position in Western Australia’s premier volcanic massive sulphide country following its acquisition of some new gold/zinc-copper-gold tenure at its Golden Grove North project in WA’s mid-west.

During late August, Venture announced it had started dry screening and associated mining activities at Riley, which sits around 85 kilometres south west of the port city of Burnie.

A direct shipping ore project sourcing a deposit that sits at surface, Riley has current reserves of 1.6 million tonnes grading 57 per cent iron and an expected strip ration of zero.

While activities started at the site in 2013, they were subsequently suspended due to a softening of the iron ore price.

So far Venture has secured an off-take agreement with a tier-one global iron ore trader (Prosperity Steel) for the (current) two year mine life, assembled a highly experienced project team to advance the completion of the decision-to-mine study and reboot of operations, as well as signed road and port access agreements.

During the RIU Resurgence Conference, the company’s managing director Andrew Radonjic said dry screening and associated mining operations had already begun, while the project economics were currently well above the 2019 feasibility study numbers, which were based on a US$90/t-62 per cent iron case.

He also noted the resources house currently had $17 million in the bank, meaning it was in a good position to get Riley up and running.

“The feasibility study done back in August 2019 …. gave us a $13 million profit, and today obviously the price is US$125 per tonne, so (the profit margin) is significantly higher than that,” Radonjic said.

“So certainly, in terms of the project only having a two year mine life, we are certainly well positioned (with) these higher prices over the next couple of years.

“In the meantime, while we are doing our dry screening operations, we’re looking to lock down our funding for the wet screening plant – we’re looking at around about circa $5.5 to $6 million to get that done.

“So, we are probably targeting late next month, and obviously the company has a great opportunity to … move from explorer to producer, so a fantastic outcome for the company.”

In terms of Venture’s expansion of its Golden Gove North project, Radonjic said the acquisition of the strategic landholding in the Yalgoo Goldfield complemented the company’s emerging VMS discovery strategy.

The additional real estate contained a “fantastic intersection” of 22m at 0.76 grams per tonne gold, 0.64 per cent copper and 1.3 per cent zinc from 38m – including 10m at 1g/t old, 0.74 per cent copper and 2.1 per cent zinc from 50m – and sat on a trend between two recently delineated VMS targets (Vulcan North and Vulcan West).

As a result of the purchase, the company’s Golden Grove North project now covers 288 square kilometres of prospective land and sits just 10km from the Golden Grove polymetallic mine.

“So, the first thing we’ll be doing is heading up there to get an EM survey done,” Radonjic told RIU delegates.