Nickel Bulls Pump Bandwagon Tyres

THE CONFERENCE CALLER: Opening Paydirt’s Australian Nickel Conference in Perth this week, Wood MacKenzie principal analyst, nickel Angela Durrant was bullish on the outlook for the forum’s featured metal.

With a full house in for the opening session, Durrant opened on fairly safe ground, acknowledging what most in attendance already knew, that being that nickel prices are currently enjoying a runin the sun thanks to the current global energy transition, which for nickel has meant ever increasing interest in the electric vehicle (EV) supply chain and production of nickel sulphate to feed EV batteries.

She provided a look at price data the boffins at Wood MacKenzie have accumulated over the past 18 months for metals that are part of the energy transition story, namely copper, cobalt, aluminium and nickel, which demonstrate how all have climbed significantly from March 2020 through to September this year.

“For nickel, in particular, after recording a low of US$11,055 on March 23 2020, prices increase steadily for the next 12 months,” Durrant said.

“If we consider nickel consumption by first use, stainless remains the market’s main consumer, currently accounting for around 70 per cent of total consumption.

“However, looking out to 2040, this share drops to 53 per cent as battery precursors for EVs and energy storage become increasingly more important.”

Battery precursors for electric vehicles currently account for just seven per cent of global nickel consumption, but by 2040 it is expected this share will have climbed to 30 per cent.

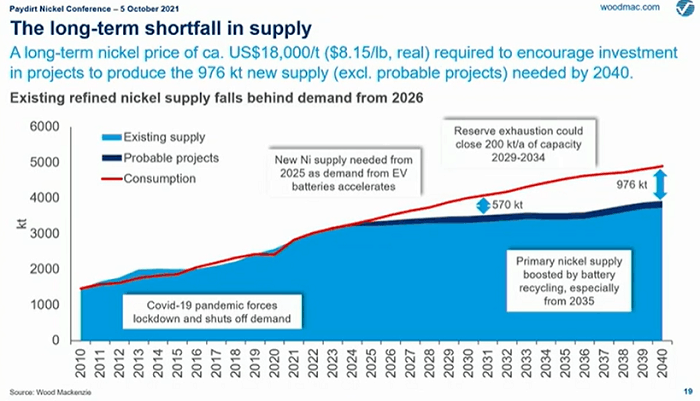

Wood MacKenzie is well on board the nickel bandwagon, with Durrant reporting for the next 20-years the firm is forecasting nickel consumption to more than double from 2.4 million tonnes in 2020 to 4.9 million tonnes in 2040.

This includes stats for nickel consumed in stainless, which Wood MacKenzie expects to hit 2.5 million tonnes in 2040 compared to 1.7 million tonnes in 2020 and nickel consumed in battery precursors reaching 1.5 million tonnes, compared with only 177,000 tonnes in 2020.

“The bottom line is that we are anticipating solid growth in demand for battery precursors above all other first-use sectors,” Durrant said.

“This view is supported by projections for electric vehicle car sales over the same 20-year period.

“We currently forecast annual sales for passenger EVs to exceed 49 million in 2040, compared to around three million in 2021 and two million in 2020.”

Not all batteries are the same and their chemical make ups differ to the point where some will maintain favour, while others will fall off the pace.

The current dominance of nickel, manganese, cobalt (NMC) batteries of the 532 and 662 variety is thought to be challenged by high-nickel 811 types by 2025.

The NMC 811 and the LFP (lithium-ion phosphate) battery types, will provide the majority of required gigawatt hours for EV batteries from 2030 onwards.

“In the next 10 years or so, it is quite possible that other configurations may find favour, but in terms of what is commercially applied right now, this is how we see the market developing,” Durrant said.

“In terms of nickel, the progressive dominance of 811 will boost consumption, but this will be countered by lower intensity of use as battery pack size gets smaller due to increasing energy density.”

Possibly one of the least surprising statements Durrant delivered during her address was that future demand for battery precursors, or sulphate, on a regional basis, would see China taking the main podium as the main consumer in the years to 2030.

“In 2021, we estimate China’s demand will total 211,000 tonnes of nickel in precursor and will increase to almost 700,000 tonnes in 2030, Durrant explained.

“In terms of supply, nickel sulphate for use in EVs will be the largest consuming sector, accounting for over 900,000 tonnes of nickel by 2030.

“Coming back to this year, we expect that nickel in sulphate production will actually start to exceed demand and that this will continue until 2025.

“This is the point, in 2025, where there will be a need for new investment in sulphate capacity.

“Our current outlook for the short-term nickel market is one of tightness.”

Despite the number of nickel miners, potential miners and explorers in the room, Durrant raised the important part to be played in the future prospects of the metal by the recycling industry.

“Given the consecutive deficits…that we are forecasting over the latter half of the decade, we expect that recycling will also become increasingly important for nickel,” she said.

“In fact, we could be so bold as to suggest the future nickel supply could be a redirection of investment funds to recycling.

“The inherent qualities of recycling make it attractive – a potential lower environmental footprint combined with the social message of moving, what is hitherto, being material going into landfill.”

Market watchers will already be aware of the companies already breaking ground in this field that are rapidly establishing themselves by collecting and processing spent batteries or through the manufacture of reusable products.

Although differences exist between the different players, most share a commonality in their small company size, and typically producing less than 10,000 tonnes of nickel in black mass, or sulphate, but potential exists for scaling up these efforts.

An important emerging factor noted by Durrant is the growing concern producers and consumers alike have with ESG in carbon dioxide emissions and the knock-on effect this has on production.

She stressed the need to produce clean, green, sustainably resourced nickel has become increasingly important and with this in mind, Wood MacKenzie has developed an emissions benchmarking tool.

“The Carbon Emissions Intensity Tool illustrates that nickel pig iron (NPI) producers in Indonesia high on the emissions curve, largely due to the intensive use of coal for power generation,” she said.

“Large integrated sulphide producers, however, sit much lower down on the curve.

“Not to disappoint, in Australia most producers, both sulphide and laterite, are closer to the lower end of the CO2 emissions curve and sit well below the weighted annual average, which I’m sure you will all be happy to know.

“These positions will become increasingly important as consumers and investors look to the source of the nickel supplying their electric vehicle batteries and their energy storage requirements of the future.”

Looking at current market fundamentals, Wood MacKenzie has determined the global nickel deficits running through to 2030 will support annual average prices approaching US$19444 per tonne by 2026, followed by even higher prices of around US$21000 through to 2029.

This could see four straight years of metal inventory drawdowns that will drastically shrink global stocks towards 100 days of consumption around 2031, a level not seen since 2005 when prices also averaged US$19980 per tonne.

“By 2026, the market will need to find new nickel, either from our extensive list of probable projects, or possible projects as well, or from elsewhere,” Durrant said.

“By 2031, the requirement for nickel from these sources is estimated to be around 570,000 tonnes…which will expand to 976,000 tonnes by 2040.

“I think worth pointing out, at this juncture, that nickel prices currently sit around US$18,000 to US$19,000 per tonne

“Even at that level, we are not seeing banks putting their hands in their pockets to finance new projects, which signals there is still much caution despite the optimism around EVs and nickel consumption growth.”