Latin Resources living large in Latin America

When speaking with Latin Resources managing director Chris Gale it’s easy to be swept up in his enthusiasm for Latin America.

Gale’s fervour for the region reaches beyond Latin Resources’ portfolio of highly-prospective projects in Peru and Brazil.

It extends to the recent history of Latin America and how, during what has been one of the most difficult periods for the junior sector, it has become a hive of exploration and mining activity.

Numbers add up, but they can also talk, and recent figures achieved in Latin America tell an interesting story.

Last year, 25 per cent of the world’s total exploration dollars were spent in Latin America.

By 2020 that figure is anticipated to rise to 50 per cent of the world’s exploration – and mining – spend, mainly distributed across six countries.

Chile-$100 billion; Brazil-$68 billion; Peru-$56 billion; Colombia-$22 billion; Mexico-$13 billion; and Argentina-$10 billion: for a total of $269 billion.

It’s though China has some $100 billion earmarked for Latin America during this time, $40 billion of which is for Peru.

.jpg)

“The current environment in Latin America is so much different to Australia,” Gale told The Resources Roadhouse.

“I can tell you why – It is better value; the geology is second to none; Peru is the second biggest copper producer in the world, Chile is number one.

“Peru is the number one silver producer in the world; Brazil is the number one iron ore producer in the world – after China.

“It is a lot more cost effective to mine there, plus only five per cent of Peru has been explored compared to around 35 per cent of Australia.”

Gale takes great pride in the fact Latin Resources was one of the first Australian junior exploration companies to establish a foothold in Latin America.

As the third Australian junior explorer to enter Latin America, it witnessed the ranks of its contemporaries quickly grow in the region to number around 80 with others eager to follow.

“World equity markets have come to understand and trust Latin America,” Gale said.

“Sovereign risk in the region is way down compared to other popular destinations such as Africa, making it a more desirable start-up location for junior companies.”

Gale’s vision also entails METS (Mining Equipment, Technology and Services) companies from Australia, which he considers to be world-class and highly proficient, also looking at selling their services in Latin America.

“Australia has a proven history of great junior exploration companies, supported by equally great geologists and engineering expertise,” he said.

“Latin America is where the future of mining is and is where they should be creating opportunities.”

As one the early movers into Latin America, Latin Resources (ASX: LRS) has been able to develop an impressive suite of projects.

Its Guadalupito iron and mineral sands project in, located on the northern coast of Peru, consists a total concession area of 17,500 hectares, which cover a 45 kilometre long mineralised shoreline that extends up to 4km inland.

The project is located 25km north of Chimbote, where there is a major port and one of the largest steel smelters in Peru.

Latin has established a 1.3 billion tonne JORC Inferred Resource at 5.7 per cent heavy minerals (HM) at Guadalupito with a conceptual exploration target of over 4 billion tonnes of mineralised sediments.

Two major minerals have been identified at the project, namely magnetite at 25 per cent of

HM and Andalusite 26 per cent of HM.

Discrete liberated mineral grains of recoverable size of zircon, rutile and ilmenite have also been identified.

“We are now ready to move Guadalupito to a feasibility study,” Gale said.

“We have secured the surface rights – ready to take it into mining when we can – and we hope to be in production at Guadalupito by the end of 2015, early 2016.

“It all really depends on when we may be able to secure a Joint Venture partner for the project.

“We have been in discussions with some candidates and we are gradually moving closer to an agreement.”

While negotiating for potential Joint Venture partners at Guadalupito, Latin recently signed a Binding Terms Sheet for a rights assignment and earn-in option to transfer 70 per cent ownership of its Ilo Norte project to Peruvian firm, Compañia Minera Zahena SAC (CMZ).

The deal entails CMZ making payment of a total consideration of US$3.65 million cash and minimum exploration work commitments totalling US$4 million plus the execution of a 4800m diamond drilling program valued at approximately US$1.35 million.

Ilo Norte is Latin’s most advanced exploration property in the south of Peru and is located right in the heart of a major copper producing region, where there are 125 billion pounds of contained copper in published reserves and resources including the Cuajone, Toquepala and Cerro Verde copper mines, all within 100km.

The Ilo Norte deal exemplifies Latin’s thinking in regards to the current fund raising climate for junior exploration companies.

By attracting a significant JV partner it has secured more financing for the company while advancing its exploration goals without having to go to the equity market for more funds.

The recent sell down of a 30 per cent interest in the Mariela iron ore project is further testament to this ideal.

“The Mariela project has been a great deal for us,” Gales said.

“We spent $200,000 to obtain some airborne and ground magnetics data, which has subsequently brought into the company – mainly through equity – but in cash, $11 million.

“We are looking at a model where we can’t go back to the market anymore; we have to self-fund our existence

“We just received shareholder approval for the Mariela deal – which means we will bank another $2.5 million by selling down our 30 per cent holding in that project.

“So we have demonstrated we can fund our activities by utilising what we have on the books right now.

“We will continue to use the Ilo Norte model to both secure funding for the company while unlocking value through exploration of our extensive ground holding in one of Peru’s hottest copper belts.”

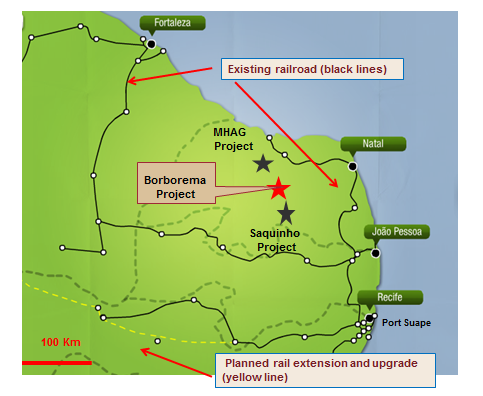

In Brazil, Latin recently acquired the Borborema iron ore project from Rio Tinto Exploration, Brazil.

The acquisition is in line with its defined strategy of identifying iron ore projects in South America if the opportunity arose and if the project was close to port and infrastructure.

Latin considers the Borborema iron ore project in Brazil fits the bill nicely, with potential for near term production of iron ore in conjunction with a suitable joint venture partner.

The project was suggested to the company by its exploration manager, Carlos Spier, who has completed extensive due diligence on the project after conducting exploration work over a six month period in the Rio Grande do Norte State.

“If you look towards 2014 and look at where we are now at the end of 2013, we have positioned ourselves pretty well,” Gale said.

“We have funded Ilo Norte for drilling, which we anticipate commencing in January.

“We have just banked $2.5 million by selling down 30 per cent of one of our assets in Mariela.

“We are now at the point where we can move into a feasibility study for Gudalupito, which we ultimately want to move into production in the next couple of years.

“Is it any wonder I’m enthusiastic about Latin America? I don’t think so!”

Latin Resources Limited (ASX: LRS)

…The Short Story

HEAD OFFICE

Suite 2, Level 1

254 Rokeby Road

Subiaco WA 6008

Ph: +61 8 9485 0601

Fax: +61 8 9321 6666

Email: info@latinresources.com.au

Website: www.latinresources.com.au

DIRECTORS

David Vilensky, Chris Gale, Frankie Li, Zhongsheng Liu, Mark Rowbottam

MAJOR SHAREHOLDERS

Junefield High Value Metals Investments 20.54%

Dempsey Resources 11.13%

SRP Read Pty Ltd 3.88%

SHARES ON ISSUE

227.5 million

MARKET CAPITALISATION

$16 million (at 5/12/13)