Iron Ore Continues on its Downward Slide.

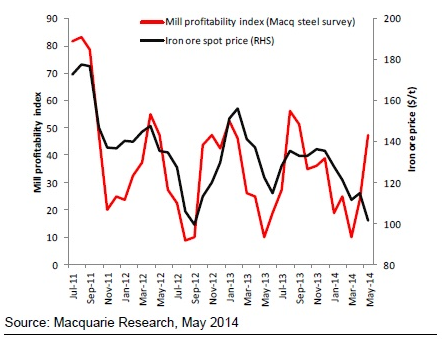

GAVIN WENDT: Iron ore prices fell for a sixth straight month during May, which represents its longest losing streak on record, with hefty supplies pushing prices to their lowest level since September 2012. During the month of May the price of iron ore fell by 13 per cent alone and is down by 32 per cent so far this year.

Some traders in China have been unloading cargoes at a loss on worries that prices could slide further, whilst Chinese steel mills are cutting back on long-term iron ore contracts in favour of cheaper spot cargoes, confident that beaten-down prices are unlikely to rebound.

It’s swings and roundabouts for the industry, because the price slide is likely to have shuttered Chinese domestic iron ore miners whose cost bases are typically above $100 per tonne.

On the other hand, seaborne supply has increased to such an extent that it has thwarted a recovery in prices. Indeed, it is this strong supply of imports that leaves the market waiting for a cut in Chinese domestic production.

Broker CLSA also highlights the fact that market rumours involving Chinese banks potentially reducing loans to steel mills by 10 per cent this year, have also weighed on iron ore prices.

In the meantime, steel mills remain cautious in raw material inventory replenishment, although prices below $100 per tonne are seeing some purchasing.

According to the latest Mysteel survey, average medium and small Chinese steel mills import iron ore inventory was 24 days last week, down from 25 days two weeks ago; whilst domestic concentrate inventory had also been lowered by 2 days to 7 days over the same period.

Major Chinese port iron ore inventory inched up by 0.7 per cent week-on-week to 111.13 million tonnes (Mt) last week, of which traders’ stock increased by 1.3 per cent week-on-week to 38.56Mt.

The market is reportedly worried that as mid-year bank loan repayments fall due, some traders may have to dump some inventory to raise liquidity.

In my view, the biggest issue impacting the iron ore price at the present time is supply.

Quite simply, the massive increase in production from the Pilbara region of WA by BHP and RIO means that the supply side is beginning to catch up with demand.

This means that prices have essentially leveled out, or indeed begun to fall.

This was always going to be the case and the market was well aware that we would eventually arrive at this particular point. So it really shouldn’t be too much of a surprise.

At the same time we have uncertainty prevailing with respect to China’s level of iron ore demand in terms of its near-term sustainability.

The market appears to be getting mixed messages out of China and there are different interpretations as to what is exactly going on.

What all of this does is emphasise how important China is to the iron ore business. China accounts for 60 per cent or the world seaborne iron ore trade, so this means that the iron ore business is unlike any other commodity. There is no other commodity business where the industry is so reliant on one particular buyer, as is the case with China and the iron ore industry.

This is a far cry from the fixed annual contract price that dominated the industry for the previous few decades.

Under those circumstances, both producers and buyers had certainty around pricing, which was both an advantage and a disadvantage, depending upon underlying market conditions.

China will go on being the world’s major steel producer and consuming huge volumes of iron ore, but we’re approaching the peak of China’s demand over the next decade or so.

This means that the world iron ore industry is going to well supplied and as a result we won’t see the high prices that we’ve seen in the past.

The international market will look closely at China and its authorities for guidance in terms of possible stimulus measures that might boost construction and overall industrial production, which could then flow through into firmer iron ore prices.

From BHP and Rio’s perspective, it’s a glass half full/half empty scenario. Although prices have fallen, sales volumes are strong, with both companies well positioned at the bottom of the iron ore cost curve.

A period of sustained lower prices could drive higher-cost competitors out of business and see BHP and RIO further entrench their position of iron ore market dominance.

The other important aspect for BHP and RIO is the issue of diversity.

They are now so heavily reliant on iron ore income that they are not really truly ‘diversified’ miners any longer.

A period of prolonged iron ore price weakness will inevitably have shareholders asking questions about the wisdom of placing all of their eggs in one basket in terms of becoming so heavily reliant on just one commodity, iron ore.

Perhaps commodities like aluminum, which Rio put so much faith back in 2007 with its $38 billion for Alcan during 2007, might represent that broadening of earnings diversity?

Gavin Wendt is the founder of MineLife, publisher of the MineLife Weekly Resource Report