Pat McManus – Potash West

The Roadhouse caught up with Potash West managing director Pat McManus at the recent Gold Coast Resources Showcase to get an update on the company’s potassium-rich glauconite deposit, the Dandaragan Trough situated in the Perth Basin of Western Australia.

Hi Pat, we last spoke in November last year, which was pretty early on in the Potash West story. What has been happening in the meantime?

There’s been a lot of activity since then, Wally. We were able to obtain the necessary approvals to allow us to drill on the roads over the project area.

We had outlined three criteria for the drilling. We were looking for intersections of at least 20 metres thick grading three per cent potassium oxide situated less than five metres from surface.

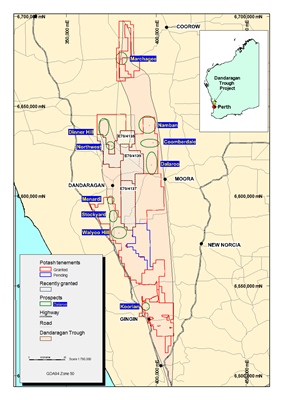

Just from our initial drilling work we have identified ten areas that meet our criteria, which range from way up in the north of the project area down to the south, a distance of over 140 kilometres. Given that the tenement package averages 20km in width the potential is very large.

We are now going back to have discussions with the farmers situated on either side of the roads we drilled in regards to drilling on the properties to see what is there with the aim of working up a JORC Resource on one or more of these areas by September.

Have any of these areas put its hand up to be selected as your most likely main target?

It is still too early to say just yet, however we have completed a round of drilling on one of them and moved on to a second.

I’d have to say that of those two, the second, which is an area located on the western section of the tenement package, is showing better results.

What about the metallurgy process you have been working on. How is that coming along?

It’s going well. We are now able to leach the potassium using a variety of acids and we have produced commercial grade products of both potassium chloride and potassium sulphate in the laboratory.

Of the two we prefer to use the sulphate acid technology as it is easier and less expensive to use and farmers prefer that style of product.

Most of the world’s potash is sold as a chloride and – in very broad terms – sulphate is a preferred ion to put on soils.

A farmer from New Zealand recently told me that irrespective of salinity issues, chlorine can poison certain plants.

He said that he is actively looking at increasing the use of sulphate in his fertiliser rather than chloride.

Would New Zealand be a potential market for you?

It could be. Part of our longer-term plan is certainly to export to the region, where we would have a logistic advantage over Canada, which exports the bulk of the world’s potash supply.

New Zealand would fit into that equation as, like Australia, they import all their potash from somewhere north of the equator, mostly Canada.

So, Australia and New Zealand would definitely be potential market places.

Our first target market however is basically Western Australia where we would like to get a relatively small plant up and running where we would have a ready market for around 200,000 tonnes plus per year.

If we can feed that then we will start looking, in parallel, at exporting opportunities.

That’s the longer view at the moment. How about the short-term?

The two major things we hope to achieve and announce in the next six months is a JORC Resource of around 70 million tonnes – we expect to do that in September.

The other will be commencing a Scoping Study in the second half of the year with results anticipated to be out around December.

Do you find people are coming to understand what potash actually is?

The Australian investing community is still working its way through a major learning curve. Globally potash is a $30 billion a year business but because there are not many Australian-listed companies operating within that space it is still relatively misunderstood.

There are a few companies looking at phosphate within Australia, but very few actually focused on potash.

So you could say that Potash West is breaking new potash ground in Australia both physically and metaphorically?

Absolutely. We are breaking new ground within the potash industry with what is an unconventional feedstock as well as breaking new ground for the Australian investment community by looking at, what is at potentially, a major potash operation.

It’s interesting what you said about an unconventional feedstock because your ground is a different host for the potash, is that right?

Correct. Most of the world’s potash, probably 90 per cent, is recovered from what are basically ancient sea beds – very deep underground seams of silvinite, which is a mixture of potassium chloride and sodium chloride.

They are usually located around one kilometre below surface and are mined using conventional underground methods or solution mining.

A small amount of potash is produced from brines and different salt lake situations.

We have a feedstock that is close to surface in sand, as a silicate. One issue is that we average lower grades at around four per cent potassium oxide but we have the ability to upgrade that, at relatively low costs, to around six per cent potassium oxide.

Most producers are mining around 15 per cent potassium oxide. We’re lower grade at surface while they’re higher grade deep underground.

Is that unique hosting environment is the reason why you have had to create the new metallurgy flowchart?

The silicate host is a strong enough bond to mean the potassium is not immediately soluble. So we need to make the potassium more soluble.

You can do that using a thermal treatment, however the route we are heading down is to utilise a chemical treatment to extract the potassium and re-precipitate it as a sulphate.

A recent fund raising was successful. How are you placed financially from that?

We recently formalised an alliance with Perth-based broking house Stellar Securities as corporate advisers to us.

They’re a new company looking for new opportunities. They liked our story and approached us to assist in marketing ourselves to the investing public.

Through them we were recently able to raise $1.5 million at a very low discount to our share price, which our shareholders were very grateful for.

We now have funds to complete our Scoping Study by year-end and still have a healthy bank account after that.